This solution is designed to manage the process of identifying and confirming corporate control. Use automation and AI to assist company administration to connect with a corporation's shareholders. Obtain each shareholders' consent and validate individual identities to government documentation.

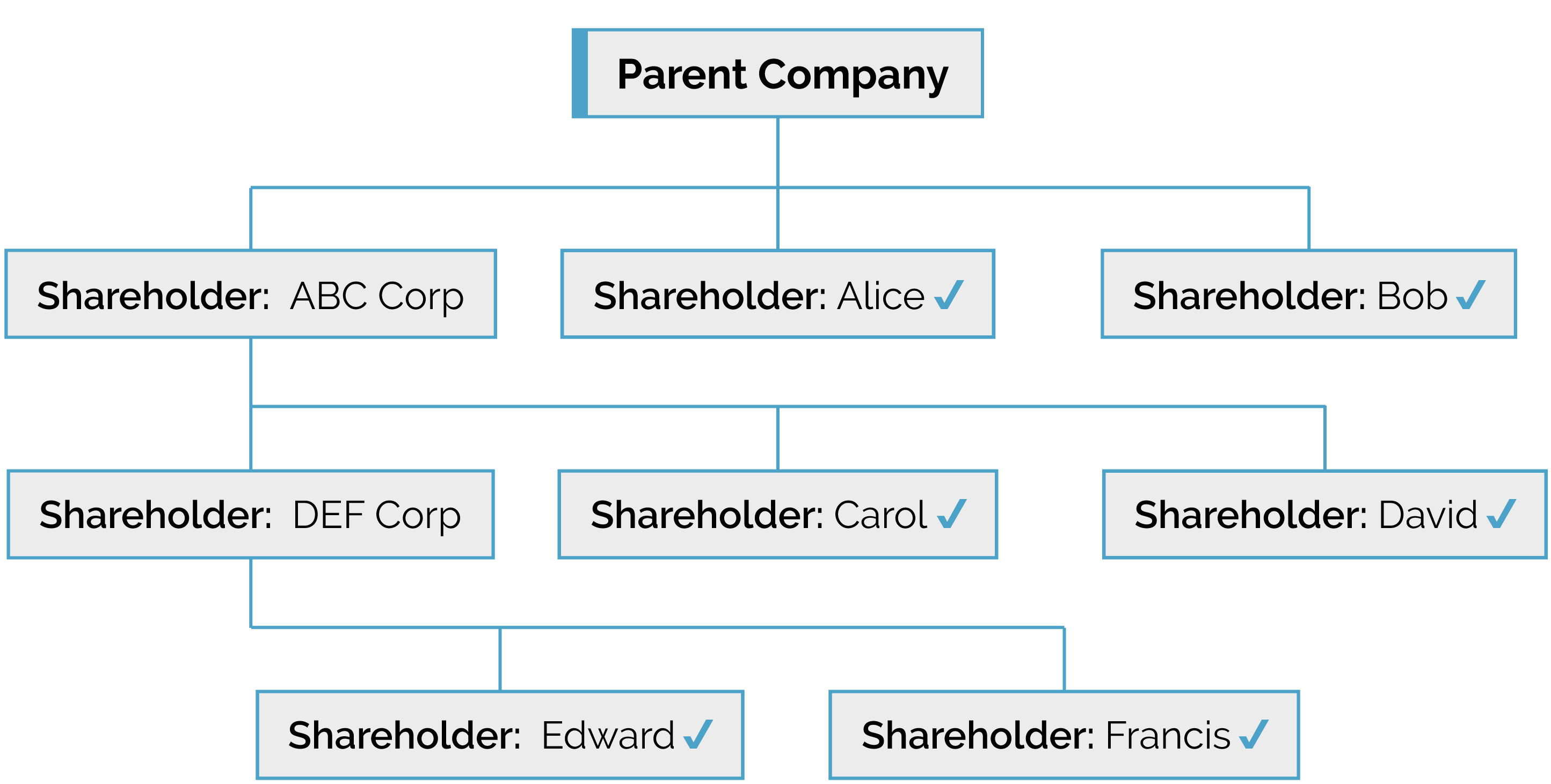

When a shareholder is found to be another corporation the process is repeated. First automatically confirming the legal status of the company. Then navigate the chain of ownership until individual owners are confirmed.

Identity:

Ultimate beneficial ownership

Controlling interests

Direct and indirect control

Aggregate voting authority

Leverage the position of trust a director, secretary or administrator has with a company's shareholder base to quickly and reliably identify ownership. Then using AI, validate shareholders. Provide tools that allow that person to quickly upload shareholder registries. If a shareholder is a person our automated IDV tools match government issued ID with facial recognition and liveness testing to confirm identity. When the shareholder is a corporation the legal status is confirmed with its government's corporation registry. Upon confirmation of valid legal status the automation repeats itself with that company's shareholder registry.