In the fast-paced and interconnected world of business and finance, it is essential for organizations to have a clear understanding of their customers. To ensure the security, reliability, and compliance of their operations, businesses must implement effective Know Your Customer (KYC) practices. This article aims to provide comprehensive answers to frequently asked questions about KYC, shedding light on its significance, requirements, compliance, and its application in various sectors.

1. What is KYC?

KYC stands for Know Your Customer (Client), and it is a set of standards and procedures implemented by organizations in the investment and financial services industry. The primary goal of KYC is to verify the identity of customers, assess their risk profiles, and understand their financial positions. By gathering and analyzing relevant information about clients, businesses can make informed decisions, tailor their services, and mitigate potential risks.

2. Why is KYC important?

• Establish the identity of their clients, ensuring that they are dealing with legitimate individuals or entities.

• Assess the risk associated with each client, enabling them to identify any unusual activity or patterns that may indicate potential illicit behavior.

• Comply with regulatory requirements and demonstrate their commitment to combating financial crimes.

• Safeguard their reputation by minimizing the risk of being associated with illegal activities.

• Enhance customer trust and confidence by providing a secure and reliable environment for financial transactions.

3. What are the components of KYC?

KYC consists of three main components: the Customer Identification Program (CIP), Customer Due Diligence (CDD), and Enhanced Due Diligence (EDD).

Customer Identification Program (CIP)

The Customer Identification Program, mandated by the USA Patriot Act in 2001, requires financial institutions to obtain specific information from customers to verify their identities. This includes collecting details such as name, date of birth, address, and identification number.

Customer Due Diligence (CDD)

Customer Due Diligence involves a comprehensive assessment of a customer's background, financial activities, and risk profile. It aims to understand the nature of the client's business, the sources of their funds, and their overall financial position. CDD helps organizations identify any red flags or potential risks associated with a customer.

Enhanced Due Diligence (EDD)

Enhanced Due Diligence is an advanced level of scrutiny applied to customers who pose a higher risk, such as politically exposed persons (PEPs) or customers from high-risk jurisdictions. EDD requires additional information gathering and monitoring to ensure compliance and detect any potential illicit activities.

4. Who is responsible for KYC compliance?

KYC compliance is the responsibility of both the organizations providing financial services and their customers. Financial institutions, including banks, investment firms, and payment processors, have a legal obligation to implement KYC measures and ensure the accuracy and completeness of customer information. Customers, on the other hand, are required to provide accurate and up-to-date information and cooperate with the KYC process.

5. What are the regulatory requirements for KYC?

KYC regulations vary across jurisdictions, with each country having its own set of rules and guidelines. In Canada the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) ensures compliance with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). In the United States, financial institutions must comply with regulations imposed by regulatory bodies such as the Financial Crimes Enforcement Network (FinCEN) and the Securities and Exchange Commission (SEC). International standards, such as those set by the Financial Action Task Force (FATF), also play a significant role in shaping KYC regulations globally.

6. How does KYC help prevent financial crimes?

KYC acts as a crucial line of defense against financial crimes by enabling organizations to assess and mitigate risks associated with their customers. Some key ways in which KYC helps prevent financial crimes include:

• Identifying and verifying the identities of customers, reducing the risk of identity theft and fraudulent activities.

• Assessing the risk profile of customers and detecting any unusual or suspicious behavior that may indicate money laundering or terrorist financing.

• Monitoring customer transactions and activities to identify any patterns or anomalies that may be indicative of illicit behavior.

• Reporting suspicious transactions or activities to the appropriate regulatory authorities, contributing to the overall efforts in combating financial crimes.

7. What are the challenges in implementing KYC?

Implementing effective KYC measures can present challenges for organizations, including:

Balancing compliance requirements with customer convenience: KYC processes should be efficient and streamlined to minimize customer dissatisfaction, while ensuring compliance with regulatory standards.

Keeping up with evolving regulations: KYC regulations are subject to change, and organizations must stay updated to ensure ongoing compliance.

Handling large volumes of customer data: Organizations need robust data management systems to securely store and process customer information while adhering to data protection and privacy regulations.

Dealing with false positives: Automated KYC systems may generate false positives, flagging legitimate customers as high risk. Organizations must have proper mechanisms in place to resolve such instances promptly.

8. What are the benefits of using an identity verification solution like Origin Confirmed?

Origin Confirmed is an innovative identity verification solution that offers numerous benefits for businesses seeking to enhance their KYC processes:

Quick and accurate identity verification: Origin Confirmed utilizes advanced technologies such as facial recognition, email and phone verification, and document verification to swiftly verify the identity of customers, ensuring reliable results.

Enhanced security and compliance: By implementing Origin Confirmed, organizations can strengthen their security measures and comply with KYC regulations, mitigating the risk of fraudulent activities and maintaining regulatory compliance.

Seamless integration and convenience: Origin Confirmed can be seamlessly integrated into existing systems, providing a user-friendly and convenient experience for both businesses and customers.

Cost-effective and time-efficient: Origin Confirmed simplifies the KYC process, reducing manual efforts and operational costs associated with traditional verification methods, while delivering quick results.

Trust and confidence: By utilizing Origin Confirmed, businesses can establish trust with their customers, demonstrating their commitment to secure and reliable operations.

9. How does KYC apply to different industries?

KYC requirements apply to various industries, including banking, insurance, cryptocurrency, and gambling. In each sector, KYC serves the common purpose of verifying customer identities, assessing risk, and ensuring compliance with regulatory standards. However, the specific KYC processes and requirements may vary based on industry-specific regulations and risk profiles.

For example, in the banking sector, KYC is essential for opening and maintaining bank accounts, ensuring the legitimacy of customers and their transactions. In the insurance industry, KYC helps assess the risk associated with policyholders and prevent insurance fraud. Cryptocurrency exchanges and platforms also implement KYC measures to combat money laundering and enhance security.

10. The future of KYC: Emerging trends and technologies

The field of KYC is continuously evolving, driven by technological advancements and changing regulatory landscapes. Some emerging trends and technologies in KYC include:

Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms can automate and improve the accuracy of customer identification and risk assessment processes, reducing manual efforts and enhancing efficiency.

Blockchain technology: Blockchain has the potential to revolutionize KYC by providing a secure and decentralized platform for storing and sharing customer data, enabling seamless and trusted verification processes.

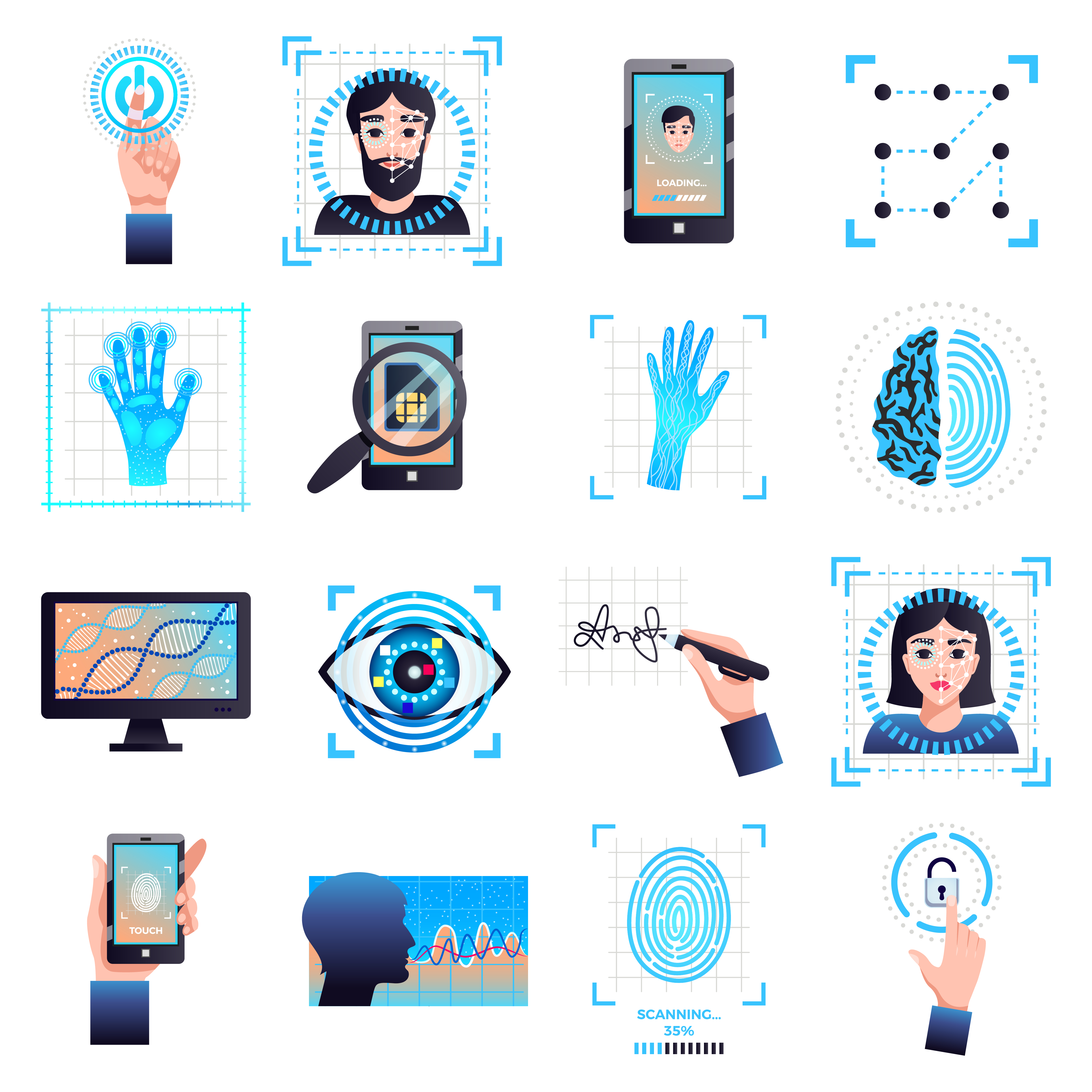

Biometric authentication: Biometric technologies, such as facial recognition and fingerprint scanning, offer enhanced security and convenience in customer identification, reducing the reliance on traditional identification documents.

Digital identity solutions: Digital identity solutions, such as digital passports or self-sovereign identity systems are gaining traction, offering individuals more control over their personal data while facilitating secure and efficient KYC processes.

As technology continues to advance and regulators adapt to emerging challenges, the future of KYC holds promise for more efficient, secure, and user-centric verification processes.

In conclusion, KYC is an essential component of the financial services industry, ensuring the security, reliability, and compliance of operations. By implementing robust KYC practices, organizations can establish the identity of their customers, assess their risk profiles, and mitigate potential financial crimes. Origin Confirmed offers an innovative identity verification solution that simplifies and enhances the KYC process, enabling businesses to operate confidently and securely in today's interconnected world.

Remember, with Origin Confirmed, you can quickly and inexpensively create confidence that the people and the data your organization works with are real. Origin Confirmed performs identity verification, facial match, facial recognition, email and phone verification in just a few seconds. It doesn't keep the data; it simply confirms it.